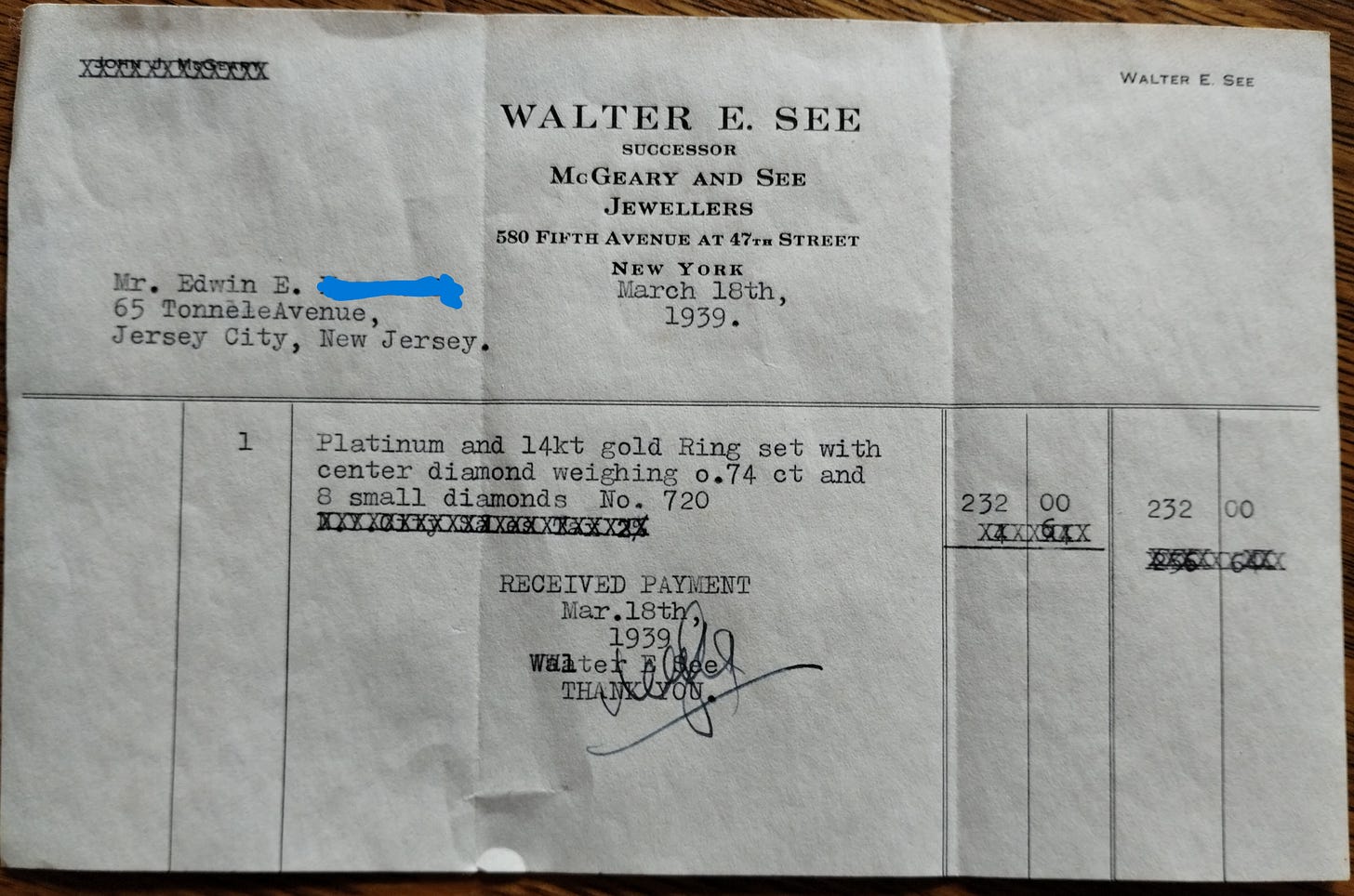

Here is a photo of a receipt that I just came across. (If you don’t see it, open this post in your browser.) It’s dated March 18, 1939. The most important thing about it to me is that it is the receipt for my mother’s engagement ring.

Think about that time. Only about a year earlier, Hitler’s troops had marched into Austria and taken it over. Earlier in 1939, Hitler announced his plans to eliminate Jews from Europe. Later in the year, Hitler invaded Poland, starting WWII. Of course, Hitler didn’t come out of nowhere; throughout the 1920s and 1930s, Hitler amassed power, largely unimpeded by well-intentioned but politically impotent leaders both inside and outside Germany.

It was a hell of a time to become engaged… But all the above is just the back story for this post. Let’s consider the receipt by itself. It is for the sum of $232. That is the equivalent of $5217 today. My father must have been making good money, right there in the middle of the Great Depression! (OK, more like the end of the Great Depression. WWII would very soon create LOTS of jobs.) And, yes, my father made good money, even in the depression. He had received his degree in electrical engineering, receiving his degree in 1925, and easily found work with the power company. At that time, both Thomas Edison and Nikola Tesla were quite active in the electrical field, and duking it out as founding representatives of General Electric (Edison) and Westinghouse (Tesla).

Oops! Distracted again! It’s about the receipt, remember? Notice that some of the typed info in the receipt has been “X”ed out. That was the sales tax, of $4.64. That means the tax was 2%. Today, the sales tax in NYC is 8.875%. (Why the tax is eliminated on this receipt is unknown.) So, let’s recap: It takes $5217 to buy what $232 bought in 1939. And the sales tax is more than quadruple!

OK, that’s sales tax, but what about income tax? Glad you asked. The first income tax was instituted to finance the civil war, and existed from 1862 to 1882. The tax rate was not graduated, but varied from 2% to 7.5% in different years. It was fairly typically in the 3% range. Having paid off the war debt, the income tax was dropped in 1883. Subsequently, direct income tax by the federal government was found by the Supreme Court to be unconstitutional. That changed, when the 16th amendment was passed in 1913, allowing for federal income tax. The rates were graduated, and it’s difficult to do an apples-to-apples comparison. But in 1913, the lowest rate was 1%. By 1918 it was 6%. Lately, it’s been hanging in at 10%.

One more thing. Recent monetary “policy” has caused rampant inflation in the last two years, such that today’s dollar only buys what 83 cents bought two years ago. That 83 cents incurs a 10% income tax, as opposed to 1% about a hundred years ago. And if you live in NYC, your 83 cents, minus 10% income tax, leaves about 75 cents, which is taxed at 8.875% when you buy something.

This is a somewhat simplistic examination, given the multitude of variables. But it’s essentially correct. Remember that old parable; a frog in a kettle with the temperature gradually increasing will be boiled alive before he realizes it’s getting too hot. I don’t know if that is really true about frogs, but it certainly is true about people.